The investor, either a real or corporate person, must be a national of a treaty country.

The investment must be substantial. It must be sufficient to ensure the successful operation of the enterprise. It cannot be marginal.

The investment must be proportional to the nature of the business.

The investment must be a real operating enterprise with verifiable

and legitimate business activities.

No job creation requirement.

Franchise acquisition acceptable.

Conditional agreement structured prior to final interview.

The investment must generate more income than just to provide a living to the investor and family, or it must have a significant economic impact in the U.S.;

The investor must have control of the funds, and the investment must be at risk in the commercial sense;

Investor must be able to demonstrate lawful origin, source and path of investment funds;

The investor must be coming to the U.S. to develop and direct the enterprise. If the applicant is not the principal investor, he or she must be employed in a supervisory, executive, or highly specialized skill capacity. Ordinary skilled and unskilled workers do not qualify;

E-2 developer due diligence checklist

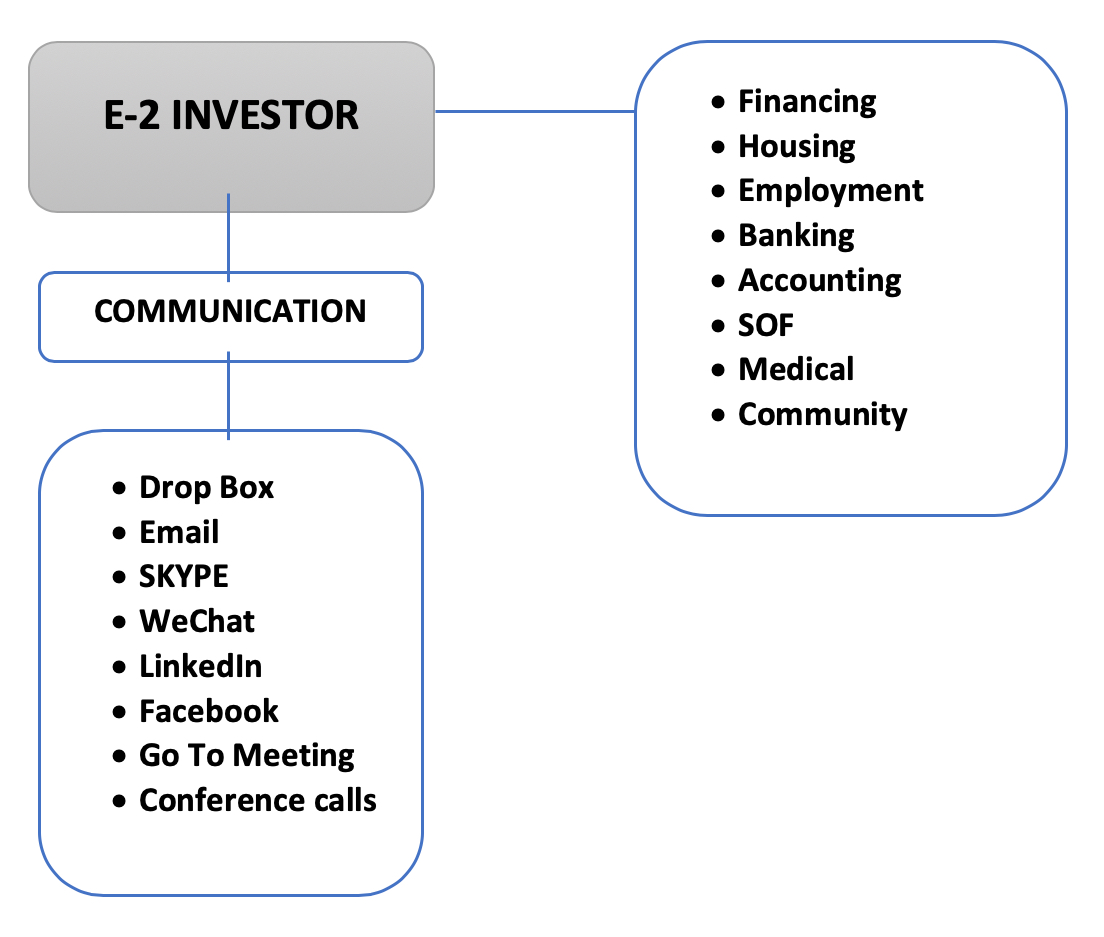

Investor chart E-2 complete structure

Investor communications

Investor considerations

Investor organizational summary

E-2 project summary checklist

Investor organizational summary

Investor sources of funds and filters

U.S. Tax Residency

Prospective E-2 Investor (Selected Countries)

Prospective E-2 Investor (Selected Countries)

Owns Any New or Existing U.S. Entity, Minimum $150,000 capitalization (LLC, Inc., Solo,)

X % ( e.g. 5% to 100%) Investor’s Entity Acquires Percentage in New or Existing Operating Commercial Enterprise + Advisory/Board Position

Master Entity Owns 100% of U.S. Operations

I. General Property Information

a. Aerial Maps

b. Property Photographs

c. Title report

d. Appraisal

e. Demographics

f. Discussion of competing properties

g. Purchase Agreement or Option Agreement

h. Phase One Environmental Report

i. Risk Assessment

j. Zoning Information

II. Financing Information

a. Lender Information

b. Dollar amount of loan

c. Term of Loan

d. Interest Rate

i. Fixed

ii. Variable and what index and margin

e. Required signers

f. Recourse requirements

g. Loan Commitment

h. Supporting Documents for financing commitments

III. Investment Objectives

a. Purpose of Investment

i. Cash flow from operations

ii. Value added

iii. Capital appreciation

iv. Tax benefits

v. Equity build up thru loan payoff

vi. Job creation

b. Sources and Uses of Funds Statement

c. Proposed duration of investment

d. Projections as to the first year of operations

e. Projections of subsequent years of operations

f. Assumptions used in making financial projections

IV. Ownership Entity

a. LLC or LP

b. Owner ship Entity (prospective structure)

i. Who is the Managing Member or Sponsor?

ii. Who will the Members be?

iii. Compensation paid to : GP / Managing Member/ RC or Sponsor during each phase

1. Acquisition

2. Operations

3. Disposition

c. Will this investment be eligible for EB-5

i. Direct

ii. Regional Center

d. Banking arrangements

e. CPA

f. Organization documents and filings

V. Risk Factors Specific to:

a. Proposed property

b. The current market

c. The investment type

VI. Sponsor Track Record

a. Education

b. Work experience

c. Track record on other projects of similar type or other

VII. Specific Information re: Land Project

a. Entitlements

i. Do any exist currently

ii. Does the project require entitlements

iii. If you do require entitlements what agencies are involved?

iv. if entitlements have been applied for previously what is the status

b. Budget re: Entitlements

c. Cost estimates:

i. Design professionals

ii. Consultants (all required)

iii. Time (estimated)

d. Projected sales and absorption figures

e. Proposed budget for construction

VIII. Information for Purchase of Existing property

a. Current or Proposed use of building

b. Property condition report

c. Statements (3 years Profit & Loss)

d. Balance sheets (3 years)

e. Proposed job creation with supporting documents

f. Proposed value after improvements are completed with supporting documents

g. Information on existing or proposed tenants

i. Financial reports

ii. Bios of personnel

iii. Business plans

iv. Track records

h. Formation documents

i. Copy of proposed lease or leases

j. Corporate or personal guarantees

k. Business plan of Sponsor

i. Decrease vacancy

ii. Increase rents

iii. Decrease expenses

iv. Job creation

IX. Investment

a. State department form

b. Job creation analysis & descriptions

c. Economic Impact Analysis on project (Geographic & Demographic)

d. Business Plan

e. Feasibility StudiesAn accordion content area

Limited Liability Company (LLC ) – State Charter (As at April 17, 2020)

Name: ……….

Type: ……….

Location: ……….

Investors: ……….

Capital Stack (projected): ……….

Job Creation: ……….

Documents Status/Availability: ……….

Experience: ……….

Special Comment: ……….

Local Support: ……….

Timeline: ……….

Equity: ……….

Phases: ……….

Risks: ……….

Equity/Loan: ……….

Summary/Recommendation: ……….

Date of Report/Time: ……….

Cost:

Benefit:

| Yr 1 | Yr 2 | Yr 3 |

| 1/6 x | 1/3 x | x days |

| x days | x days |

= 183 or > 183 (122)

This chart is used to approximate U.S. Tax residency imposition or qualification. Consult a qualified U.S Tax accountant or attorney.

If you are interested in the E-2 visa program, please feel free to contact us. We will get back to you with 1 business day. Or if in hurry, just call us now.

Call : (1)954-524-8888

larry@e2lawyer.com Mon – Fri 9AM- 5PM